Engagement & Retention project | IndMoney

Understand your product

IND Money is a company in the financial technology sector that strives to make personal finance management easier and more efficient for individuals. They have developed a platform that brings together accounts, such as bank accounts, credit cards, investments and loans. This platform offers users a picture of their financial well-being enabling them to monitor their expenses, analyze their investment portfolios and make the most of their savings/investments.

Since its launch in 2019, the application has quickly grown to 9Mn users backed by innovative features such as US Stocks investing, Neo Banking, Deposits and Financial life tracking & management.

INDmoney is backed by reputed foreign institutional investors comprising Tiger Global, Steadview Capital, Dragoneer, Sixteenth Street Capital who have invested a total of $143Mn in the Super Finance App.

Mission 🎯: Improve your financial future by helping you to save and earn more.

Vision 👁: Be the one stop shop for your finances — Your Family's Super Money App

Brief Overview

Value Proposition

The core value proposition of IND Money is to simplify and optimize personal finance

management for individuals. The platform offers a comprehensive solution that integrates

various financial accounts and provides users with a holistic view of their financial health.

Here are some key aspects of IND Money's value proposition:

1. Financial Aggregation: Consolidate all financial accounts in one place for easy management.

2. Expense Tracking and Budgeting: Track expenses, set budgets, and gain insights into spending patterns.

3. Investment Advisory: AI-powered recommendations for personalized investment decisions.

4. Goal-based Planning: Set financial goals and receive guidance to achieve them.

5. Demat & Trading account: Open your paperless free Demat account online with Zero AMC and trade stocks on a daily basis for financial gains.

Yeah, fine with the Value props, but how do Customers experience it?

Note: would have loved to attach all the screenshots of the value proposition but the app do not allow to take screenshots stating the image contains personal information. Happy from a user point of view, but sad from the assignment doer point of view :’)

1. Financial Aggregation: While the customers open the app for the first time, the app asks them for their PAN no. and access to their emails. Once provided, boom!!! All your account balances, investments, expenses, net worth in front of you in 2 minutes which means you don’t have to go looking for their portfolios anywhere else……AHA!

2. Expense Tracking and Budgeting: Users can track their spendings with multiple caveats to it and get insights into their spending patterns. For example, it can show me how much I spend from my bank account on shopping and travel, and it can also tell me how much I spent from my credit card on coffees and food….sad realizations incoming.

3. Investment Advisory: When you further deep dive into the app and open your portfolios, it gives AI-powered recommendations for personalized investment decisions and let’s you know where you can save more by investing into direct mutual funds,

where does your portfolios overlap and which funds are recommended to diversify properly.

4. Goal-based Planning: The app also helps the users to set financial goals and receive guidance to achieve them in terms of retirement funds, emergency funds and even health and life insurances.

Other notable mentions in which users experience the value propositions are:

1. Weekly reports and alerts about the investment’s performances, spends, net worth fluctuations and their respective action items with a CTA attached.

2. Advisory notification services basis changing market conditions any fund changes its risk adversity or devaluations or high-risk commissions

3. Save small, save daily plans: Encourage users to start investing with as low as ₹10 in Mutual Funds & Stocks

What is the natural frequency of your product?

1. Casual Users - Engages with the app once every month to check their wealth status and health and using no additional feature.

2. Core Users - Engages with the app at least 1-2 times a week and apart from wealth status checks, engages with stock and portfolio movements, for SIPs, expense tracking, advisory services.

3. Power Users - Engages with the app almost daily and use the app for trading stocks and reviews in addition to all the features mentioned above.

Do you have other sub products? What is their natural frequency like?

1. IND Learn: A comprehensive guide built to educate and simplify financial decisions. The aim is to make financial education accessible through bite-sized courses designed by experts. Their natural frequency should be daily since they are bite-sized and provides certifications as well.

2. INDStock Screeners: Helps the users to research, evaluate & filter among 5000+ US Stocks easily for investing or trading. Their natural frequency should be weekly since screeners are most evidently used by traders and investors to analyse their picks.

3. IND Insurance: Personalised Life and Health Insurance plans to Secure your family's needs and protect your hard earned savings with the right insurance policies. Natural frequency should be once a month for premium payments, can increase in case of medical or health emergencies.

4. IND Insta Cash: A flexible credit line exclusively available only for INDmoney members to Withdraw amount as per their emergency need transferred to your bank account instantly repay with interest. It cannot have a set frequency as it is an emergency fund.

What is the best engagement framework for your product?

Primary: Frequency of Engagement

Metrics:

● Number of logins or app visits per user per week/month: This metric measures how

frequently users are accessing the platform

● Number of transactions per user per week/month: This metric indicates the frequency of

core actions, such as making investments or conducting financial transactions.

Hypothesis:

This focuses on building habits and increasing the frequency of core actions in the product. For IND

Money, a financial services platform, increasing user engagement and habit formation is crucial. IND

Money can deepen its relationship with users and increase wallet share by encouraging users to

regularly engage with the platform via frequent transactions or interactions

Secondary: Depth of Engagement

Metrics:

● Average transaction value per user: Measures the average amount of money spent by users on the platform, indicating the level of financial commitment and intensity of engagement.

● Portfolio growth rate: Tracks the percentage increase in the value of users' investment portfolios month-on-month or quarter-on-quarter, reflecting the depth of engagement and the effectiveness of the platform in helping users achieve their financial goals

● Time spent on advanced features or tools: Measures the amount of time users spend on more advanced features or tools offered by IND Money such as screeners or recommendations, indicating their willingness to explore and utilize the platform's full capabilities.

Hypothesis:

This emphasizes the intensity of user engagement, either in terms of time or money spent. While frequency is important, it's also essential to focus on users who spend more time or money on the platform. IND Money can identify these high-value users and provide them with tailored experiences or exclusive benefits to further deepen their engagement.

Not Applicable: Depth of Engagement

Metrics:

● Adoption rate of new features: Tracks the percentage of users who actively start using

newly introduced features or products, indicating the level of interest and engagement

with new offerings.

● Cross-feature usage: Measures the extent to which users explore and utilize multiple

features or products within the platform, indicating the breadth of engagement and the

effectiveness of cross-promotion efforts.

Hypothesis:

While this framework is valuable, I would prioritize it lower for IND Money compared to the other two frameworks. Once users are engaged and habitually using the platform, then IND Money can introduce new features or products to further enhance their experience and increase overall engagement.

Summary: By prioritizing the frameworks in this order, IND Money can focus on building habits, deepening engagement with high-value users, and then expanding the breadth of features and products. This approach ensures a strong foundation of engaged users and allows for strategic growth and innovation.

Action(s) that makes someone an active user for your product:

1. Users who link their PAN and give access to mails for tracking their financial investments and spending history

2. Users who visit the app at least once a month to check their monthly investment insights

3. Users who either have at least one SIP through the app or track their SIPs regularly through the app

User Segmentation

ICP/ Persona Based:

1. Casual User Janhavi:

Janhavi is a 25-year old Marketing Assistant who recently graduated from college

and started her first job. Since she recently started having an monthly income, she

wants to take control of her finances and develop good money management habits.

However, she finds financial jargon overwhelming and is unsure where to start.

Janhavi downloaded the IND Money app to simplify her financial journey. She uses

IND Money occasionally to check her account balance, track monthly expenses,

and receives notifications for bill payments. Janhavi appreciates the app's simplicity

and user-friendly interface, which helps her stay organized and make informed

financial decisions.

2. Core User Anurag:

Anurag is 35 years old and is a Software Engineer at JPMC. He is a tech-savvy

individual who has been investing in the stock market for several years. He came on

IND Money because it was an only convenient option to invest in US-based

company stocks. He values the convenience and efficiency of managing his

investments through the IND Money app and actively tracks his investments,

analyzes their performance, and receives personalized investment

recommendations based out of screener usage results. He now have become

habitual with the other features of the app and regularly utilizes the app's financial

planning tools to set long-term goals, such as saving for retirement or buying a

house. He appreciates the app's comprehensive features and data-driven insights,

which help him make informed investment decisions.

3. Power User Pranav:

Pranav is 28 years old Financial Analyst at an major IB firm. Since Pranav is a

seasoned finance professional with a deep understanding of the investment

landscape, he does swing trading based of his knowledge (As explained by him, he

actively invest and divest in stocks biweekly to gain some additional financial gains)

and hence, relies on IND Money to stay updated on market trends and make

data-driven investment decisions. Pranav extensively uses the app's advanced

investment research tools such as screeners to conduct detailed portfolio analysis,

track market movements, and identify potential investment opportunities. Pranav

actively engages with the app's other features as well such as learn and US stocks

investing and use his expertise gathered over years. Pranav appreciates the app's

robust features and the ability to customize his investment strategies based on his

unique insights

Casual/Core/Power:

User Persona | Casual User | Core User | Power User |

Discovery of App | Word of Mouth in office, Ads on Instagram | From collogues at work | Online search for wealth management app |

Frequency of Usage per month | 2-3 times per month | 10-15 times per month | 25-30 times per month |

Features Used | - Check account balance - Track monthly expenses - Receive bill payment notifications | - Track investments - Analyze performance - Receive personalized investment recommendations - Utilize financial planning tools | - Conduct portfolio analysis - Track market movements - Engage with community forums |

Features They Would Like to Explore | - Automated savings plans - Personalized budgeting tips | - Tax optimization strategies - Investment diversification tools - Real-time market data | - Options trading - Advanced risk management tools - Access to exclusive investment research reports |

Why They Choose IND Money? | User-friendly interface and simplicity | Comprehensive features and data-driven insights | Robust features and ability to customize investment strategies |

| |

Engagement–Campaigns

Campaign 1 | “Financial Fitness Challenge” Campaign |

Target Segment | Casual users of IND Money |

Problem Statement | Limited engagement on the app, lack of basic financial management habits and knowledge |

Solution | Encourage regular app usage by having learning materials to learn about finance basics |

Pitch/Content | Take Control of Your Finances with IND Money! Join the financial fitness challenge! Complete 5 modules of finance |

Channel Used | In-app notifications, email, social media |

Incentives/ Offer Made | Trackers, spreadsheets, invites or badges for completing financial tasks, personalized budgeting tips and tutorials |

Frequency of Campaign | Monthly |

Success Metrics | - Click-through-rate - Increase in app usage - Completion rate of financial tasks - % signups post task completion - User feedback and satisfaction ratings |

Rewards as free stocks (IND is popular on this!!!)

Campaign 1 | Core User Engagement Campaign |

Target Segment | Core users of IND Money who are amateurs in the field of money management |

Problem Statement | Limited exploration of advanced features and potential disengagement |

Solution | Enhance user loyalty and encourage deeper engagement with advanced tools and resources |

Pitch/Content | Unlock the Full Potential of Your Investments with IND Money! Join our Investment Masterclass and learn from industry experts. |

Channel Used | Email, in-app notifications, webinars, blog posts |

Incentives/ Offer Made | Exclusive access to investment masterclass, personalized investment recommendations, advanced feature tutorials |

Frequency of Campaign | Quarterly |

Success Metrics | - Workshop registrations - Increase in engagement with advanced features - Attendance rate for webinars - User satisfaction and retention rate |

Campaign 2 | “Masterclass” Campaign (Core to Power) |

Target Segment | Core users of IND Money who regularly visits the app to check their investments and use insights from the platform |

Problem Statement | Limited exploration of advanced features and potential disengagement |

Solution | Enhance user loyalty and encourage deeper engagement with advanced tools and resources |

Pitch/Content | Unlock the Full Potential of Your Investments with IND Money! Join our Investment Masterclass and learn from industry experts. Optimize your portfolio with our advanced tools and receive personalized recommendations based on your risk profile."" |

Channel Used | Email, in-app notifications, webinars, blog posts |

Incentives/ Offer Made | Exclusive access to investment masterclass, personalized investment recommendations, advanced feature tutorials |

Frequency of Campaign | Quarterly |

Success Metrics | - Workshop registrations - Increase in engagement with advanced features - Attendance rate for webinars - User satisfaction and retention rate |

Campaign 3 | “Trade Master” Campaign (Power to Champion) |

Target Segment | Experienced power users which are active traders on the platform and have high trading volumes |

Problem Statement | Increase trading volumes on the platform and incentivize power users to trade even more to boost user engagement and increase revenue for the platform |

Solution | Create a gamified leaderboard campaign where power users compete to have the highest trading volumes. By introducing a competitive element, we can tap into the power users' motivation to win and encourage them to trade more frequently and in larger volumes |

Pitch/Content | Participate in the “Trade Master” Contest and the user the highest trading volumes by DD/MM/YY wins a waiver to their Intraday and F&O trades for a month!! Let the trades begin! |

Channel Used | Email, in-app notifications, webinars, blog posts, trade success pages |

Incentives/ Offer Made | Trading waiver to the winner, reduced trading fees, cashback, or exclusive perks for the participants |

Frequency of Campaign | Semi-annually |

Success Metrics | - Increase in overall trading volumes during the campaign period - Number of active power users participating in the campaign - Growth in the number of new power users - Social media engagement and reach - Increase in user retention and repeat trading activity - User satisfaction and retention rate |

Retention

Bird's-eye view

What is your current retention rate in terms of users?

To get an overall understanding of retention in the app, we have to take an overview of the industry and then try to dig down on the numbers for the players like INDMoney.

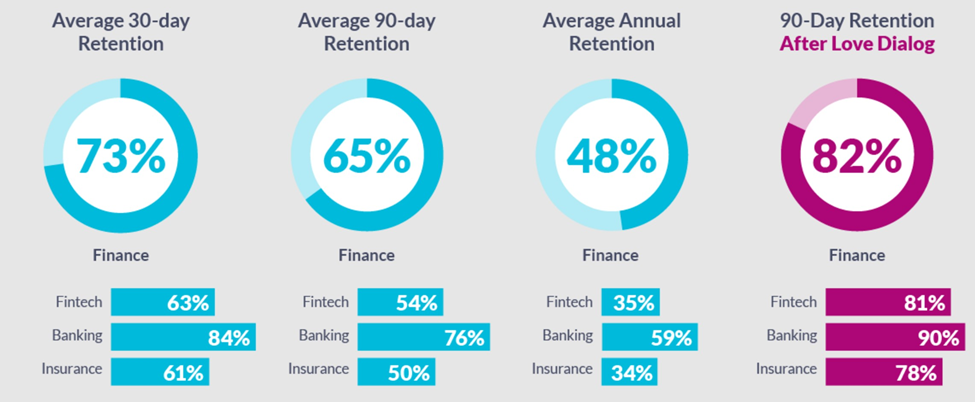

As per the report by Alchemer by the title “Finance Apps: 2022 Mobile Customer Engagement Benchmarks”, they bifurcate the finance apps typically in three subcategories:

1. Fintech (credit score, mortgage, stocks and bonds, loan consolidation, etc.)

2. Banking (banks and credit unions)

3. Insurance (auto, home, life, renters, pets, etc.)

For the following graphs, we emphasize on the Fintech Metric necessarily as IND Money falls under that bracket.

Interaction and Response:

Consumer Sentiment

Retention:

Now, It’s likely that Finance apps see lower churn than other categories due to the simple fact that it’s harder for people to change banks and shift their financial planning tools than it is to, say, try a new restaurant. Hence, the banking apps in the fintech sees the highest numbers in retention.

At what time period does your retention curve flatten? Draw the retention curve.

Microscopic view

Which ICPs drive the best retention?

1. ICP 1 (Janhavi): She primarily use the app for basic financial management tasks such as checking account balances, setting budgets, and receiving bill payment reminders. While these users are important for the overall user base, their retention may not be as strong as other users.

2. ICP 2 (Anurag): Anurag has a higher level of commitment to managing their finances as they regularly track their investments, analyze performance, and utilize the app's financial planning tools and are likely to have a stronger retention rate. However, they may not drive the best retention for IND Money.

3. ICP 3 (Pranav) : Power users like Pranav are highly engaged and have a deep understanding

of the investment landscape. They actively utilize advanced features, such as real-time market data, customizable investment strategies, and personalized trading insights. Users like Pranav are likely to have the highest retention rate for IND Money due to their extensive usage, active participation, and commitment to utilizing the app's advanced features.

Best channels to drive retention:

IND Money gets their maximum volume of users through organic searches.

The best channels to drive retention for them will be in-app notifications as well as WhatsApp because the user base is generally driven through the apps and WhatsApp helps in designing a fastest CTA for the system.

Sub Product Feature | Key Points |

IND Learn |

|

IND Stock Screeners |

|

IND Insurance |

|

IND Insta Cash |

|

Top Reason for Churned Users

Voluntary Churn | Involuntary Churn |

● Lack of engagement and perceived value ● Availability of better alternatives ● Changing financial needs and lack of adaptability ● Lack of trust or security concerns ● Technical issues and poor app performance ● Inadequate customer support ● Lack of product updates and innovation | ● Pricing or cost concerns ● Shifting to a foreign location ● Diversifying assets to an unavailable asset class such as housing/automobile ● Major change in financial conditions |

What are the Negative actions to track?

1. Decreased Activity: A significant decrease in user activity, such as reduced logins, fewer interactions with features, or a decline in the frequency of app usage, can be a strong indicator of potential churn.

2. Non-Usage of Key Features: If users stop using key features that are essential for their financial management, such as investment tracking, budgeting tools, or personalized recommendations, it may suggest a loss of interest or dissatisfaction with the platform.

3. Negative Feedback or Support Interactions: Users who provide negative feedback, express frustration, or have multiple interactions with customer support regarding unresolved issues or concerns are more likely to churn.

4. High Bounce Rate or Short Session Duration: Users who quickly leave the app or website without engaging with any content or spending minimal time on the platform may indicate a lack of interest or dissatisfaction.

5. Negative Sentiment on social media or Review Platforms: Users who express negative sentiment, complaints, or dissatisfaction with the platform on social media, app store reviews, or other review platforms may be at risk of churning.

Retention: Campaigns

Campaign 1 | “Rekindle the fire” Campaign (Verge of churn to at least Casual) |

Target Segment | Users who have shown signs of decreased activity or engagement on the IND Money platform. |

Problem Statement | Decreased activity and potential churn risk due to loss of interest or dissatisfaction. |

Solution | Re-engage users by addressing their concerns, providing personalized solutions, and offering incentives to encourage them to become active on the platform again. |

Pitch/Content | Hey [User's Name]! Your financial journey is our top priority, and we're here to help you navigate it with ease and confidence. Discover our latest features, personalized recommendations, and expert insights to unlock your full financial potential. Let's reignite your financial goals together and make every step count. Head to the IND Money app and let's continue this incredible journey. We've got something special waiting for you! |

Channel Used | WhatsApp, Email |

Incentives/ Offer Made | Exclusive access to premium features for a limited period, discounted trade rates, cashback on investments, or personalized financial planning sessions. |

Frequency of Campaign | Bi-weekly or monthly, depending on the user's level of disengagement |

Success Metrics | - User Activity: Monitor the increase in user activity, such as logins, feature usage, and session duration. - Feature Adoption: Track the adoption rate of key features targeted in the campaign. - Conversion Rate: Measure the percentage of users who respond to the campaign and become active again. |

Campaign 2 | “Do More” Campaign (Casual to at least Core) |

Target Segment | Users who have recently returned to the IND Money platform but are showing minimal engagement or interaction. |

Problem Statement | Users are not fully utilizing the platform's features and resources, resulting in limited engagement and potential churn risk. Need to create a plan in which users diversify their investments and make it with the app to ensure retention |

Solution | ● Emphasize the opportunity to diversify their portfolio. ● Mention the ease of opening a DeMat account with your platform. ● Showcase the user-friendly features and tools available on the platform. |

Pitch/Content |

portfolio! Diversify your investments with access to the world's largest stock market. DD/MM/YY and get US stocks worth INR500 free! Don't miss out on this opportunity to revitalize your investments with free US stocks! |

Channel Used | WhatsApp, In-app notifications |

Incentives/ Offer Made | Free US stocks up to $500 for opening a DeMat account with us. |

Frequency of Campaign | It is recommended to start with a weekly campaign for a duration of 4-6 weeks. |

Success Metrics | - Number of users who open a DeMat account as a result of the campaign. - Increase in user engagement metrics such as login frequency, time spent on the platform, and number of trades executed. - Conversion rate of users who open a DeMat account to active users on the platform |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.